Page 159 -

P. 159

์

ิ

ิ

ิ

ื

ิ

โครงการหนังสออเล็กทรอนกสด้านการเกษตร เฉลมพระเกียรตพระบาทสมเด็จพระเจ้าอยู่หัว

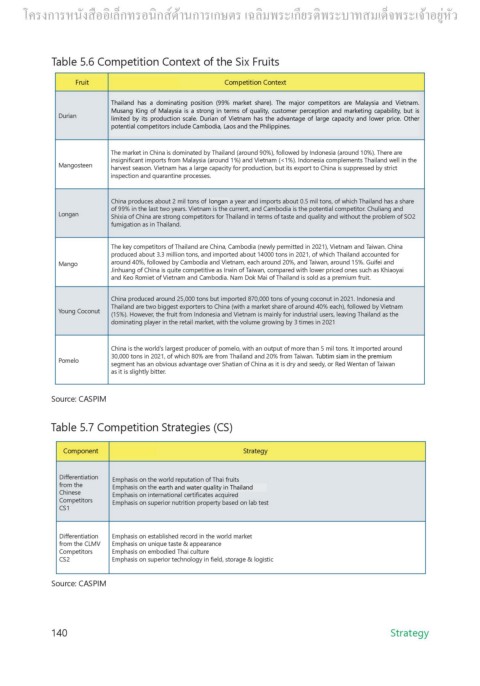

Table 5.6 Competition Context of the Six Fruits

FruitFruit Fruit Competition Contextext Competition Context

Competition Cont

e). The major competit

or

99% mark

et shar

Thailand has a dominating position (

Thailand has a dominating position (99% market share). The major competitors are Malaysia and Vietnam.e Malaysia and Vietnam.

s ar

Thailand has a dominating position (99% market share). The major competitors are Malaysia and Vietnam.

eting cap

, cust

ong in t

omer per

f quality

ms o

Musang King o

Musang King of Malaysia is strong in terms of quality, customer perception and marketing capability but isability but is

er

ception and mark

f Malaysia is str

Musang King of Malaysia is a strong in terms of quality, customer perception and marketing capability, but is

oduction scale. Duria

f Vietnam alr

DurianDurian limited by its production scale. Durian of Vietnam already exists in Chinese market. It has the advantage of largege

eady exists in Chinese mark

ed by its pr

limit

antage o

f lar

n o

et. It has the adv

limited by its production scale. Durian of Vietnam has the advantage of large capacity and lower price. Other

acity and low

or

mission v

cap

n the o

fficial per

er

y soon. Other pot

capacity and lower price and will gain the official permission very soon. Other potential competitors includes include

er price and will gai

ential competit

potential competitors include Cambodia, Laos and the Philippines.

Cambodia, Laos and the Philippines.Cambodia, Laos and the Philippines.

The mark et in China is dominat ed by Thailand (ar ound 90%), follow ed by Indonesia (ar ound 10%). Ther e ar

The market in China is dominated by Thailand (around 90%), followed by Indonesia (around 10%). There aree

insignificant imports from Malaysia (around 1%) and Vietnam (<1%). Indonesia complements Thailand well in theell in the

insignificant impor ts fr om Malaysia (ar ound 1%) and Vietnam (<1%). Indonesia complements Thailand w

Mangost

Mangosteeneen harvest season. Vietnam has a large capacity for production, but its export to China is suppressed by strictessed by strict

ge cap

v

est season. Vietnam has a lar

acity for pr

t t

o China is suppr

oduction, but its expor

har

inspection and quarantine pr ocesses

inspection and quarantine processes..

ts about 0.5 mil t

f which Thailand has a shar

f Longan a y

ons, o

ons o longan

oduces about 2 mil t

China pr

ear and impor

China produces about 2 mil tons of Longan a year and imports about 0.5 mil tons, of which Thailand has a sharee

ent, and Cambodia is the pot

o y

ential competit

of 99% in the last two years. Vietnam is the current, and Cambodia is the potential competitor. Chuliang and. Chuliang and

ear

f 99% in the last tw

or

o

s. Vietnam is the curr

LonganLongan Shixia of China are strong competitors for Thailand in terms of taste and quality and without the problem of SO2f SO2

oblem o

f China ar

er

s for Thailand in t

ms o

or

ong competit

e str

f tast

e and quality and without the pr

Shixia o

fumigation as in Thailand.fumigation as in Thailand.

f Thailand ar

ed in 2021), Vietnam and T

or

s o

mitt

The key competitors of Thailand are China, Cambodia (newly permitted in 2021), Vietnam and Taiwan. Chinaaiwan. China

e China, Cambodia (newly per

The k

ey competit

produced about 3.3 million tons, and imported about 14000 tons in 2021, of which Thailand accounted fored for

oduced about 3.3 million t

ons, and

ed about 14000 t

t

ons in 2021, o

impor

pr

f which Thailand account

aiwan, ar

ound 20%, and T

ar

and Vietnam, each ar

ed by Cambodia

ound 40%, follow

MangoMango around 40%, followed by Cambodia and Vietnam, each around 20%, and Taiwan, around 15%. Guifei andound 15%. Guifei and

e competitiv

e as Ir

win o

ed with low

aiwan, comp

Jinhuang o

f China is quit

ar

f T

Jinhuang of China is quite competitive as Irwin of Taiwan, compared with lower priced ones such as Khiaoyaier priced ones such as Khiaoyai

and K

and Keo Romiet of Vietnam and Cambodia. Nam Dok Mai of Thailand is sold as a premium fruit.emium fruit.

omiet o

f Thailand is sold as a pr

f Vietnam and Cambodia. Nam Dok Mai o

eo R

China pr

ed 870,000 t

oduced ar

ons but impor

ons o

ound 25,000 t

f y

China produced around 25,000 tons but imported 870,000 tons of young coconut in 2021. Indonesia andoung coconut in 2021. Indonesia and

t

s t

Thailand ar

e o

et shar

Thailand are two biggest exporters to China (with a market share of around 40% each), followed by Vietnamed by Vietnam

f ar

o China (with a mark

er

o biggest expor

ound 40% each), follow

e tw

t

Y

Young Coconutoung Coconut (15%). However, the fruit from Indonesia and Vietnam is mainly for industrial users, leaving Thailand as thes, leaving Thailand as the

, the fruit fr

er

om Indonesia and Vietnam is mainly for industrial user

(15%). How

ev

er in the r

olume gr

etail mark

dominating play

et, with the v

dominating player in the retail market, with the volume growing by 3 times in 2021owing by 3 times in 2021

f pomelo, with an output o

ed ar

s lar

ons. It impor

China is the world's largest producer of pomelo, with an output of more than 5 mil tons. It imported aroundound

o

China is the w

e than 5 mil t

t

gest pr

oducer

orld'

f mor

โอท

ั

ิ

มสยาม in the pr

บท

f which 80% ar

ons in 2021, o

30,000 tons in 2021, of which 80% are from Thailand and 20% from Taiwan. ส้มโอทับทิมสยาม in the premium emium

ม

aiwan. ส Tubtim siam in the premium

e fr

30,000 t

om T

om Thailand and 20% fr

้

P

Pomeloomelo segment has an obvious advantage over Shatian of China as it is dry and seedy, or Red Wentan of Taiwan aiwan

entan o

, or R

antage o

y and seedy

f T

f China as it is dr

er Shatian o

segment has an obvious adv

v

ed W

as it is slightly bitt

as it is slightly bitter.er.

Source: CASPIM

Table 5.7 Competition Strategies (CS)

S

ComponentsComponents Strategyegy Strategy

Component

trat

Differentiationentiation Emphasis on the world reputation of Thai fruitss

Differ

f Thai fruit

eputation o

Emphasis on the w

orld r

from theom the Emphasis on the Earth and water quality in Thailandality in Thailand

fr

th and wat

er qu

Emphasis on the Earth and water quality in Thailand

ear

ChineseChinese Emphasis on international certificates acquiredd

es acquir

e

national cer

tificat

er

Emphasis on int

Competitorss Emphasis on superior nutrition property based on lab testest

or

Competit

oper

ty b

Emphasis on superior nutrition pr

ased on lab t

CS1CS1

orld mark

Differ

d in the w

ecor

e

Emphasis on established r

Differentiationentiation Emphasis on established record in the world markett

Emphasis on unique tast

from the CLMVom the CLMV Emphasis on unique taste & appearancence

e & appeara

fr

Competit

Emphasis on embodied Thai cultur

Competitorss Emphasis on embodied Thai culturee

or

field, st

echnology in

Emphasis on superior t

CS2CS2 Emphasis on superior technology in field, storage & logisticorage & logistic

Source: CASPIM

140 Strategy