Page 121 -

P. 121

ิ

์

ื

ิ

โครงการหนังสออเล็กทรอนกสด้านการเกษตร เฉลมพระเกียรตพระบาทสมเด็จพระเจ้าอยู่หัว

ิ

ิ

$ ! " 3 # .

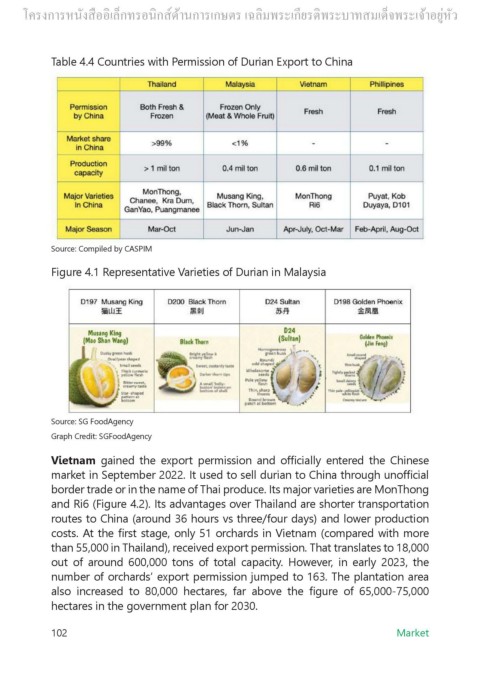

Table 4.4 Countries with Permission of Durian Export to China

8. P102 figure 4.1 (Revised)

Source: Compiled by CASPIM

1 % $ 413

Figure 4.1 Representative Varieties of Durian in Malaysia

!) 0 + 6 # .

ꢀ

Source: SG FoodAgency

Graph Credit: SGFoodAgency

Graph Credit: SGFoodAgency

Vietnam gained the export permission and officially entered the Chinese

ꢀ

market in September 2022. It used to sell durian to China through unofficial

officially 1 $

border trade or in the name of Thai produce. Its major varieties are MonThong

, ?,,! unofficial $ #

and Ri6 (Figure 4.2). Its advantages over Thailand are shorter transportation

% ! E + 0 L 8 !,9! + +

routes to China (around 36 hours vs three/four days) and lower production

8 /L + M# 9 "

costs. At the first stage, only 51 orchards in Vietnam (compared with more

% % ! 4 fi 7 G) % 6 8% "

than 55,000 in Thailand), received export permission. That translates to 18,000

G G7??? 97 % + ! )>7??? #

L ??7??? # % % ! - " + 7 ,?,/7 $ # %

out of around 600,000 tons of total capacity. However, in early 2023, the

E )L/! % >?7??? % 7 # $ +

number of orchards’ export permission jumped to 163. The plantation area

fi # LG7???H=G7??? % + # ,?/?!

also increased to 80,000 hectares, far above the figure of 65,000-75,000

hectares in the government plan for 2030.

102 Market