Page 127 -

P. 127

%

% # reflected %

# 8 ! 97 + " +

% # % 8 !G9!

# # $ % # % 7 + "

% % ̶ Q 1 ̶ ̶ % % ̶ 7 ̶ Q 1 ̶ 7

̶ 3 fl ̶ 7 ̶ 4 $ " ̶ 7 ̶ 1 fl + ̶ 7 ̶ 0 # ; # # ̶

̶ 0 ̶ !

# @ % # % # ̶ ̶ ̶ 1 K

8死包9̶ " # " 7 ̶ 0 ̶ 7 ̶

̶ 7 ̶ K 1 ̶ !

# ̶ . % 0 ̶ 7 ̶ 4%% 0 ̶ 7 ̶ * ̶ 7

̶ 1 + ̶ % % # % !

+ + # 7 " $ + # "

) % ,/)7L>< ฿)G7<LL ,?,)!

9

+ " " ,<?7=/G ,?)<7 $ + " ฿))7=G,

$ ,?)<! %% % 7 profitable

8 $ !L9!

9

, + H)< B 3 + + %

ื

โครงการหนังสออเล็กทรอนกสด้านการเกษตร เฉลมพระเกียรตพระบาทสมเด็จพระเจ้าอยู่หัว

์

ิ

ิ

ิ

ิ

,?,, + + )>)7)<> ฿),7 <<

, ?,,! + % 7 " + 7 L< ฿M 7 #

,?,)!

$ !L 6 6 # ,?)>H,?,)

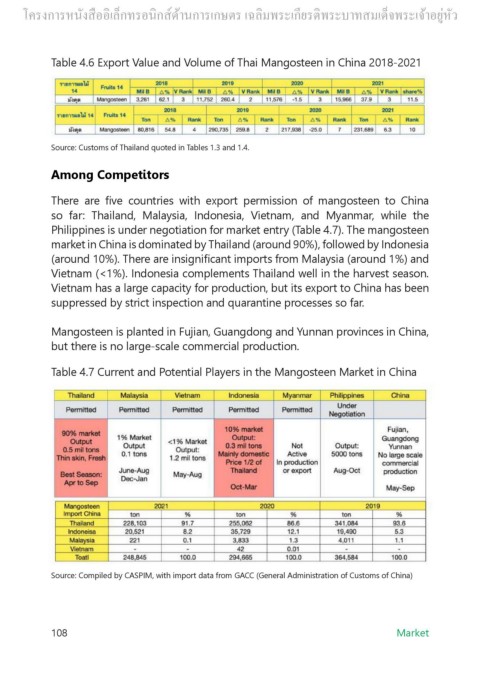

Table 4.6 Export Value and Volume of Thai Mangosteen in China 2018-2021

1 % # @ $ )!/ )! !

Source: Customs of Thailand quoted in Tables 1.3 and 1.4.

Among Competitors

There are five

countries with export permission of mangosteen to China

<

so far: Thailand, Malaysia, Indonesia, Vietnam, and Myanmar, while the

fi+ % " # # 7

Philippines is under negotiation for market entry (Table 4.7). The mangosteen

7 7 6 7 7 " 3 #

market in China is dominated by Thailand (around 90%), followed by Indonesia

8 $ !=9! $ 8

(around 10%). There are insignificant imports from Malaysia (around 1%) and

<?A97 # " $ 8 )?A9! insignificant #

8 )A9 6 8

)A9! % " + !

Vietnam (<1%). Indonesia complements Thailand well in the harvest season.

6 % % # % 7 $ $ $

Vietnam has a large capacity for production, but its export to China has been

% % @ % # !

suppressed by strict inspection and quarantine processes so far.

E 7 ( 2 + % 7 $

Mangosteen is planted in Fujian, Guangdong and Yunnan provinces in China,

H % % % % !

but there is no large-scale commercial production.

$ != 3 3

Table 4.7 Current and Potential Players in the Mangosteen Market in China

1 % $ 413 7 " # (4 8( 4 # # 30 9

Source: Compiled by CASPIM, with import data from GACC (General Administration of Customs of China)

# $

$ + % % 7 % ; 7

Market

108

% 7 % # % 7 E H% %

# % 7 K 7 C.7 3 . . 1 8 $ !G9!

# " % # ¥50/kg ¥95/kg, " %

# + !

) ?